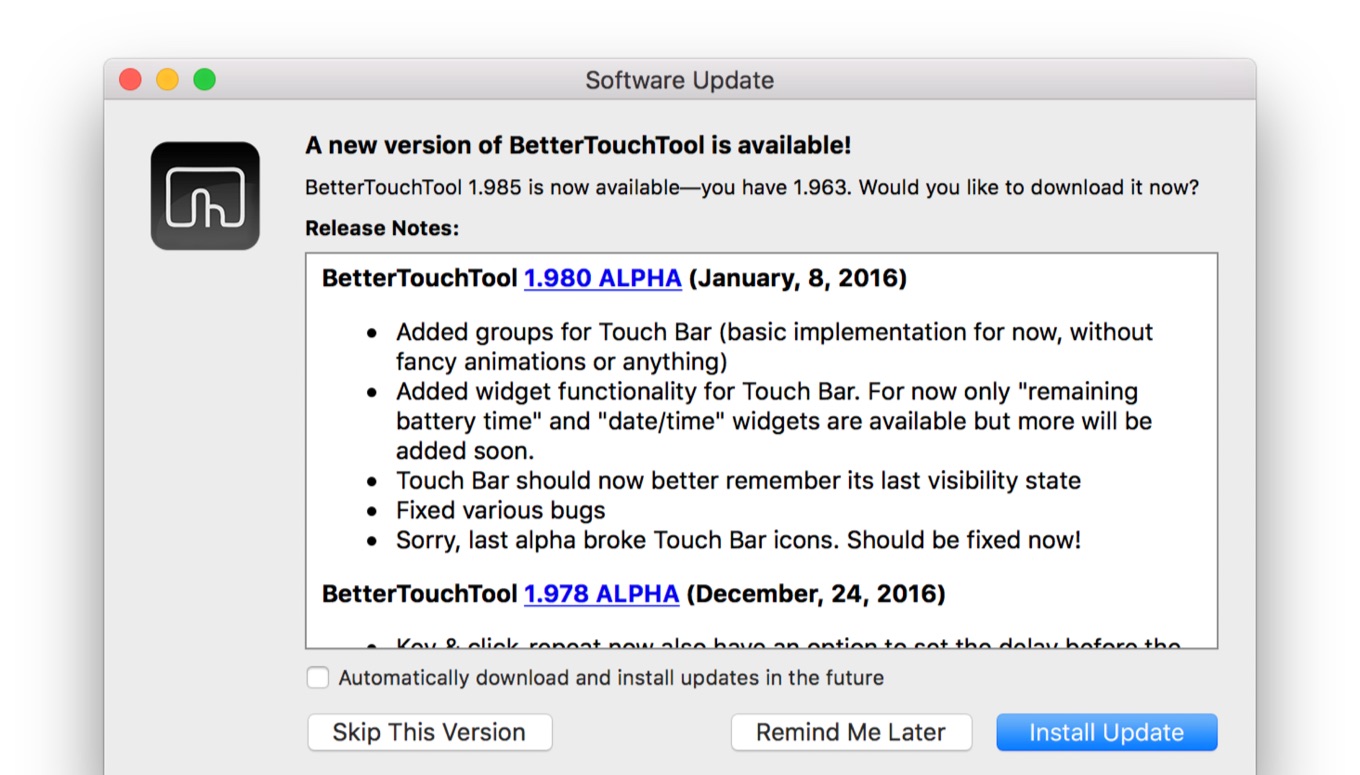

Worship in the Splendor of Holiness - Oh sing to the LORD a new song; sing to the LORD, all the earth! Sing to the LORD, bless his name; tell of his salvation from day to day. Declare his glory among the nations, his marvelous works among all the peoples! For great is the LORD, and greatly to be praised; he is to be feared above all gods. For all the gods of the peoples are worthless idols. BetterTouchTool 1.963 mac zip BetterTouchTool 1.963 mac zip 10.08MB Other Create Time: 2019-03-20 Files: 1 Total size: 10.08MB Seeders: 2 Leechers: 0.

- Bettertouchtool 1 963 Area Code

- Bettertouchtool 1 963 =

- Bettertouchtool 1 963 Feet

- Bettertouchtool 1 963 Engine

Xcom 2 1 0. Dropbox 2.2.12 - Online synchronization tool with Finder integration; free 2 GB account. (free): '

Dropbox is an application that creates a special Finder folder that automatically syncs online and between your computers. It allows you to both backup files and keep them up-to-date between systems.

Note:You must first sign up to use Dropbox. Wattagio 1 2 2 – manage your macbook battery health.

The Dropbox application is available for OS X, Windows, and Linux. A video on the site explains more.

Version 2.2.12:

- Fix an issue that could cause high CPU usage during reindex.

- Fix an issue with the tray icon on Mac.

- Fix a rare issue that caused unnecessary reindexing of the entire contents of a Dropbox.

- Fix a rare issue with Selective Sync.

- Other minor fixes.

OS X 10.4 or later

Download Now'

(Via MacUpdate - Mac OS X.)

(a)Repeal of section 963. Except as provided in paragraphs (b) and (c) of this section, the provisions of section 963 and §§ 1.963-1 through 1.963-7 are repealed for taxable years of foreign corporations beginning after December 31, 1975, and for taxable years of United States shareholders (within the meaning of section 951(b), within which or with which such taxable years of such foreign corporations end.

(b)Transitional rules for chain or group election -

(1)In general. If a United States shareholder (within the meaning of section 951(b) makes either a chain election pursuant to § 1.963-1(e) or a groupelection pursuant to § 1.963-1(f) for a taxable year of such shareholder beginning after December 31, 1975, then a foreign corporation shall be includible in such election only if -

(i) It has a taxable year beginning before January 1, 1976, which ends within such taxable year of the United States shareholder, and

(ii) It is either -

(A) A controlled foreign corporation or

Bettertouchtool 1 963 Area Code

(B) A foreign corporationby reason ofownership of stock in which such shareholder indirectly owns (within the meaning of section 958(a)(2)) stock in a controlled foreign corporation to which this subparagraph applies.

(2)Series rule. Tone2 saurus 2 0. If any foreign corporation in a series of foreign corporations is excluded by subparagraph (i) of this paragraph from a chain or groupelection of a United States shareholder for its taxable year, then any foreign corporation in which the United States shareholder owns stock indirectly by reason ofownership of stock in such excluded corporation shall also be excluded from such election to the extent of such indirect ownership regardless of when its taxable year begins.

(3)Illustration. The application of this paragraph may be illustrated by the following example:

(b) M's indirect 100 percent stockinterest in B will be excluded from any chain or groupelection made by M for calendar year 1976 since B is a controlled foreign corporation which does not have a taxable year beginning before January 1, 1976, which ends within the taxable year of M beginning after December 31, 1975, for which M has made either a chain or groupelection.

(c) M's indirect 60 percent stockinterest through A and B in D and E will be excluded from any chain or groupelection made by M for calendar year 1976 since such 60 percent interests are indirectly owned by M by reason of its indirect ownership of stock in B, which is a foreign corporation which does not have a taxable year beginning before January 1, 1976, which ends within the taxable year of M beginning after December 31, 1975, for which M has made either a chain or groupelection.

Bettertouchtool 1 963 =

(d) If C used the calendar year as its taxable year and was therefore excluded from a chain election made with respect to it and D, then D would also be excluded from such an election, since D would then be a foreign corporation in which M owns stock indirectly by reason ofownership of stock in C, which is excluded from such election.

Bettertouchtool 1 963 Feet

(c)Deficiency distributions. The rules relating to deficiency distributions under section 963(e)(2) and § 1.963-6 shall continue to apply to a taxable year beginning after the effective date of the repeal of section 963 in which it is determined that a deficiency distribution must be made for an earlier taxable year for which a United States shareholder made an election to secure the exclusion under section 963 but failed to receive a minimum distribution.

Bettertouchtool 1 963 Engine

(d)Special adjustments pursuant to section 963 to be taken into account for taxable years subsequent to the repeal of section 963. If a United States shareholder of a controlled foreign corporation elects to receive a minimum distribution under section 963 for a taxable year, section 963 and the regulations thereunder may require certain elections and adjustments to be made in subsequent taxable years. These elections and adjustments shall be taken into account for subsequent taxable years as if section 963 were still in effect and no election to receive a minimum distribution were made after the effective date of the repeal of section 963. Examples of these elections and special adjustments include, but are not limited to, the election which may be made pursuant to § 1.963-3(g)(2), relating to the special extended distribution period, and the special adjustments to be made pursuant to § 1.963-4, relating to the minimum overall tax burden test.